As the Church’s economic power has increased over the years, so has the volume of criticism about the way the Church invests and spends those resources. These criticisms are coming from within and without the Church. To be sure, they are not new. The Godbeite dissenters disagreed with President Brigham Young’s territorial economic policy. Elder Maxwell noted in 1996 the presence of “real tares” masquerading as wheat, “who lecture the rest of us about church doctrines in which they no longer believe” and “criticize the use of church resources to which they no longer contribute.” Those who leave the faith frequently point to church finances as one of the factors in their lost testimony and decision to step away.

While there are a number of other effective responses to this challenge to some peoples’ faith, both in this magazine (see Aaron Miller’s essay here) and elsewhere (such as Kathleen Flake’s recent commentary), there are two economically ignorant assumptions that critics of the Church’s finances have often made which have not been challenged but which should be.

Is Lack of Spending Really Why So Many Suffer?

The first unexamined and problematic assumption is this: The Church has vast resources which they are greedily hoarding or misspending. If it were not for the Church’s greed, they could alleviate a lot of suffering and poverty. If the Church would just write a check, poverty, disease, and a lot of suffering could be greatly reduced.

The first question this raises is who would the Church write a check to? Is there some institution that has the expertise, capacity, and capability to alleviate all the suffering in the world, yet merely lacks sufficient resources? Obviously, there is no such worldly institution. The Church searches far and wide for well-run, effective organizations, and it partners with them anytime that’s possible.

Resources Follow Solutions—Effective Solutions Attract Resources

You see, lack of money is usually a symptom, not the core problem. That doesn’t mean we should ignore the problem, it just means we need to think carefully about how to solve it; hardly ever is it as simple as writing a check! When it is free to do so, capital chases success and flees failure. This means that lack of resources is rarely the cause of the problem and more often simply a signal pointing to a deeper underlying problem. But because it’s the most simple and obvious one, it’s easy to assume that poverty is the cause rather than an effect.

Nineteenth-century economist Frédéric Bastiat wrote about the key difference between money and wealth (or as he calls it, “riches”). He says confounding the two “is the cause of errors and calamities without number.”

For wealth, according to Bastiat, is not “a little more or a little less money.” Instead, it’s “bread for the hungry, clothes for the naked, fuel to warm you, oil to lengthen the day, a career open to your son, a certain portion for your daughter, a day of rest after fatigue … instruction, independence, dignity, confidence, charity … progress and civilization.” Money, therefore, is the store and symbol of wealth, but not wealth itself.

We are all alarmed at the growing problem of homelessness in many cities across the United States right now. Many cities have devoted ever-increasing funds to this problem. For example, San Francisco now spends one billion dollars a year on homelessness, and that is on top of all the state and federal programs also devoted to this problem. It’s easy to walk down the street of a wealthy city like San Francisco and shake your head, appalled that there is such poverty among such wealth. You wouldn’t be wrong, but if you assume that homelessness is because of greedy people hoarding their wealth at the expense of the poor, you have missed the point. As journalist Erica Sandberg said, “If our problems could be solved with money, our problems would have been solved a long time ago. It’s not the funding, it’s policy.”

In fact, as Michael Shellenberger has documented, the money spent on solving the problem has actually made it worse, because it misdiagnosed the problem. While housing costs in San Francisco are outrageous, most of the people living on the streets are dealing with drug addiction and other mental illnesses, and no amount of cheap housing can solve that problem. He agrees with Sandberg, claiming that the homelessness problem does not stem from a lack of money or social programs.

Oprah Winfrey was deservedly praised for her generosity when she started a lavishly funded all-girls boarding school in South Africa, but she was recently heartbroken to learn of a series of sex scandals in the school. This is not to say that she shouldn’t have opened this school, only to say that even large amounts of money cannot guarantee success. Perhaps even more important than money are accountability, identifying effective solutions, properly implementing them, and diligent follow-through, while being willing to make adjustments as time goes on. This means you will very often start small and then expand from there—while recognizing this hard truth: The bigger the initial investment, the more likely it is to fail. It is likely for this reason that the Church’s Humanitarian Services continues to grow and expand its reach slowly and surely, rather than quickly-but-ineffectively.

Spending is About the Future, Problems are About the Past

It’s hard to know if an investment will bear fruit. In hindsight, what seems inevitable seemed at the time like something else—perhaps a hugely risky bet worth taking. Apple’s decision to enter an already saturated mobile phone space was controversial at the time, and understandably so. They couldn’t know if they would make any money on their iPhone until after they spent all the money developing it and manufacturing the first production run of their first model. The same thing goes with their next product—if they gave away all their profits as increased salaries or bonuses, they wouldn’t have any money to develop and manufacture their next product. Some companies are too profligate in their spending, and some are too penurious, but since they do not know the future with any certainty, investments are often a difficult decision to make beforehand. The Church’s Humanitarian Services continues to grow and expand its reach slowly and surely, rather than quickly-but-ineffectively.

Most of the criticism towards the Church is that it has been too conservative with its spending, but that seems even more difficult to second-guess when we shift from capitalist profits to Christian prophets. If we believe that the leaders of the Church are prophets, seers, and revelators, and we sustain them as such, perhaps it would also be fair to assume that they know more about what is coming, and how best to prepare for it, than we do?

Beyond a Certain Point, It’s Hard to Spend Money Faster than You Earn It

Because most of us are not billionaires, we do not understand how wealth works. (Oddly, sometimes this includes even wealthy people like Utah billionaire Jeff Green who complained that the Church wasn’t doing enough “to alleviate human suffering.” If he and others are sincere in this complaint, then comments like these also betray a misunderstanding of how wealth works.) At some point not only are your daily cares more than adequately supplied, but it becomes very difficult to spend more money than you earn. This is something very few of us can comprehend, since so much of our physical effort, time, and mental energy is consumed by providing for ourselves and our families. We naturally assume that much wealthier people and organizations have similar troubles, but they don’t.

Jennifer Risher writes about this shift in her own thinking when she and her husband, ground floor investors in both Amazon and Microsoft, suddenly became wealthy. As a friend explained to her:

“Moira likened the experience of sudden wealth to mentioning your love of beef to a friend, then having two thousand head of cattle arrive as a gift to your door. ‘What the hell do you do with two thousand steers?’ she said. ‘You need to know how to deal with them and that’s very different than eating a steak.’”

We also know the opposite example, where lottery winners with no experience managing wealth suddenly get a great deal of money. It’s disheartening how many of them go broke and ruin their lives as well. Their problem was never lack of money, it was the skills to manage the resources they were given.

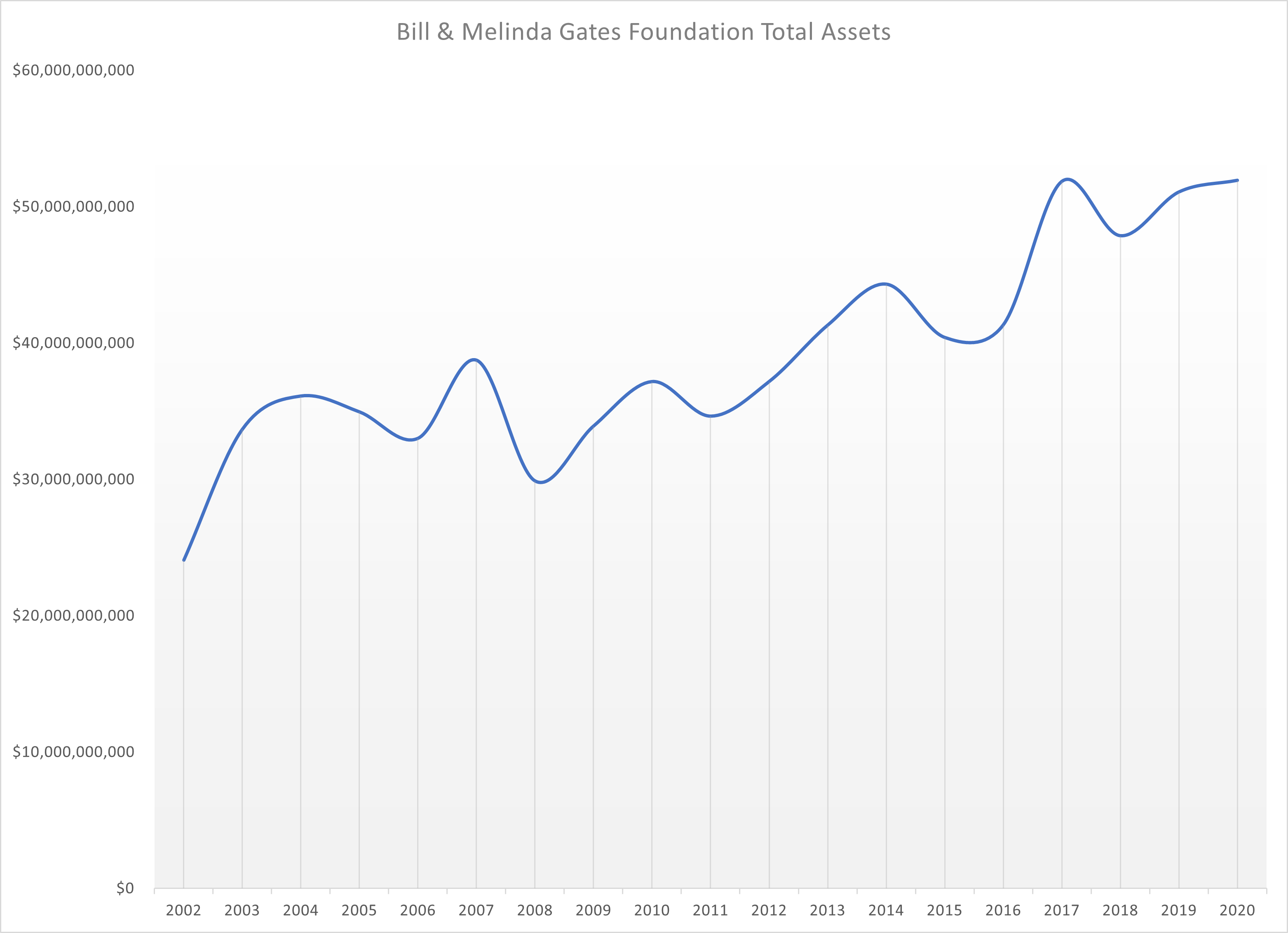

Before we look at the Church, let’s look at a secular example of an organization devoted to improving the world. The Bill and Melinda Gates Foundation, despite spending $60 billion on grants, has nevertheless more than doubled in size. (Their financial information is disclosed on their website here, but I have distilled that information onto a spreadsheet you can access here, along with some other calculations I make in this article so you can check my math.)

This graph charts the total value of the assets in the Gates foundation. While it does bounce around a bit year to year based on market performance, over time the assets of the foundation have steadily grown. And remember, this growth includes the $60 billion in grants and other expenses that the foundation spent.

Despite a full-time staff devoted to handing out grants, a mandate to spend money, and no shortage of problems in the world, the Gates Foundation has been unable to spend more money than it earns through its investments. They have no need for a “rainy day” fund, but their assets are still growing. They certainly could spend more money, for example by converting their assets to cash and then lighting it on fire, but that would set a poor example with their grantees, whom they expect to actually do some good with the money they give them.

Capital Expenditures are Distinct from Operating Expenses

The second economically ignorant error is thinking of capital expenditures the same way you think of operating expenses.

Our daily bread is the most obvious example of an operating expense. It is spent, and then it is gone. Like the manna in Ancient Israel, you could eat the manna for today, but you could not keep the manna for tomorrow. Tomorrow’s manna had to come tomorrow. No amount of manna today will alleviate the need for manna tomorrow. Food, water consumption, medicine, are all examples of ongoing operating expenses.

Because the same money can be spent on just about anything, you can spend it on operating expenses, or you can spend it on capital expenses. Imagine you are a farmer, but you also have to eat. You can eat your seed corn (operating expenses), or you can plant it (capital expenses). Each bears very different results. One will keep you alive in the near term (operating expenses), but potentially at the expense of starving in the long term (planting that seed for the harvest later in the year.) You have to have a balance, but you absolutely can’t neglect capital expenses or you soon won’t have any resources to spend on operating expenses.

Unlike operating expenses, capital expenses amortize. That means that while you spend the money upfront and once, you can keep using the asset long after you incurred the cost. The farming equivalent is a farmer buying a more efficient tractor. While he has to spend that money upfront, he can use that new tractor for many years, and in many ways, it pays for itself in improved operational efficiencies. In the case of buildings, like temples and even shopping malls, the expense can be spread out over the decades (and even sometimes centuries) of the usable life of the asset, and these assets, in turn, pay spiritual and temporal dividends over that same time period. This is not the case with operating expenses, which recur regularly.

A while ago I visited Saint Peter’s Basilica in Rome, and I was awed at its grandeur and beauty, not to mention the craftsmanship and courage it took to construct. But I couldn’t fail to wonder if all that wealth could have been used to better effect—especially because there were many indigent people nearby begging for alms.

Yet it has stood for 405 years as a testament to the faith of the largest Christian denomination, inspiring and uplifting several lifetimes worth of Catholics worldwide. Constructed over a period of 109 years, it cost 50,000 ducats to build, or about seven billion in today’s dollars, which works out to just over seventeen million per year. With an estimated 1.2 billion Catholics, that works out to less than 1.5 cents per year per currently living Catholic, or if paid in one lump sum for each Catholic, $1.08 per currently living Catholic. (We’re assuming all Catholics who lived before now contribute nothing to its construction.)

Or to think of it in reverse, if the Vatican sold off Saint Peter’s Basilica for what it cost, dismantled it and sold off the scrap, then distributed the proceeds to each Catholic, it would give each of them a one-time payment of $5.83. And what about next year? The building is no longer there to inspire and lift, and the $5.83 would be long gone as well.

City Creek

We can do the same thing with the assets of the Church of Jesus Christ. While there is really no comparison to Saint Peter’s, we can still use math to estimate City Creek shopping center’s financial impact on the average member, as it seems to be the most common financial asset the disaffected currently complain about.

It was built for an estimated $1.2 billion. But remember, this is an amortizing capital expense. It opened in 2012 and should easily have a life span of at least 50 years. That means that even if City Creek never recovered that expense through its rents, and even if these funds came from tithing funds (which they did not), the total cost of the project to each member works out to be $72.02, or amortized over its expected useful life, $1.44 per year. Based on the average US salary and a member paying 10% to the Church, withholding your own share of that would mean you pay 9.97% on your increase instead. While you would be disobeying the spirit of the law, and I doubt receive the full blessings of tithing, you would be close enough to 10% that no one else would notice. This makes it seem even more foolish to withhold that 9.97% because you object to the way the 0.03% was spent.

Put another way, if you have shopped at City Creek and parked at a nearby parking meter, you spent more on parking than your share of the cost of the entire development. And if you bought a pair of shoes while you were there, that would exceed your lifetime share of the cost.

Of course, back in the real world, I am confident that City Creek is earning the Church a healthy return on its investment. At an eight percent average return for most investments, that means your “investment” in City Creek will earn the Church $5.76 a year or $288.06 over the amortized lifetime of the project, or four times the initial expense. And this assumes that the rents do not appreciate and the asset lasts no longer than 50 years, both of which are unlikely.

Two Parables Apply: The Widow’s Mite and the Talents

I am grateful that our church leaders take seriously their sacred responsibility to carefully steward the sacred tithing funds. The widow’s mite is an important parable for all Christian believers, and the Church’s attitude is so refreshing compared to the way governments spend tax dollars that are collected by the force of law, and so often wasted. In comparison, church leaders are careful and trustworthy.

While the widow’s mite is certainly important, the critics of the Church’s finances forget an equally important parable, which is the parable of the talents. The same Monday Morning Money Managers who feel City Creek is wasteful and a poor investment then turn around and criticize the Church for making too much money with their public investment manager, Ensign Peak Advisors. We have already discussed how it is not as simple as it might appear to wisely spend extremely large sums of money, and so then the question becomes, what should the Church do with those excess funds?

I think everyone agrees that the Church ought to save some portion of its contributions and profits for a rainy day, it’s just some dispute how much they may have set aside. (I expect the impact of COVID-19, and now the war in Ukraine has altered many peoples’ calculations of what is a reasonable reserve.)

But let’s set that point aside. If the Church should save some of its excess funds against a rainy day, then what should it do with those funds? Should it just keep funds as cash, where it earns barely anything in actual terms, and when corrected for inflation, actually loses money? To do so would correspond to the slothful servant who buried the single talent he was given. The Lord rightfully condemns those who, like the slothful and fearful servant, do not wisely invest what they have been entrusted with to earn the best possible returns.

By the standard of the parable of the talents, church leaders are wise stewards. By coincidence, the same year that Ensign Peak Advisors was founded is also about when I started working at my first “grown-up” job which included a 401(k) with an employer match. So it’s rather easy for me to compare the performance of my investments with the Church’s over similar time periods. And it’s somewhat depressing for me to admit that this particular Monday Morning Quarterback has been sacked, way behind the line of scrimmage. The Church has earned far better returns on my tithing funds than I could have if I had kept that money and invested it myself.

The Church has always been careful to collect as much income as it can from these sacred tithing funds. When I started as a freshman at BYU in 1988, I was called to be an assistant financial clerk. We still used typewriters to send in tithing reports and used handwritten receipts. Right after we reconciled the financial batch, we would place a phone call and report to the bank the amount of the deposit just before one of the members of the Bishopric went to the bank to make the deposit. Why? I was never told, but in addition to the accountability check on the Bishopric entrusted with those sacred funds, it was also probably because the Church could begin earning interest on those sacred donations within minutes of it being collected. If the Church took that much care to collect a few hours’ worth of interest, they are careful stewards indeed.

Much of the financial criticism of the Church comes from naïve individuals who do not understand wealth or investing, and who second-guess our inspired leadership’s stewardship of the assets and income the Church has. From my own work in real estate and finance, and working with extremely wealthy people, I reach a very different conclusion. As reflected above, I believe there is a strong and unappreciated rationale confirming that our Church leaders have been good and faithful stewards of the sacred funds with which they have been entrusted.