In late October 2022, a writer named Ben Schneiders published an article in The Sydney Morning Herald, followed by a 60 Minutes Australia broadcast he produced one day later in a coordinated media campaign that paints a dark and accusing picture of finances in The Church of Jesus Christ of Latter-day Saints in Australia. Jana Riess of the Salt Lake Tribune and RNS Religious News Service then references the Australian articles in her own piece dated October 31, 2022. For much of the article, she appears to sound objective and open to waiting for the truth to come out, but in her heading and in the last paragraph, she seems to be fully onboard with the baseless Aussie allegations. Others, like KUER, Axios, and Fox-13, are now passing along the same claims as objective “findings,” with the Salt Lake Tribune online headline reading, “Is the LDS Church playing fast and loose with tax laws in Australia?” Similar questions are being raised relating to church donations in Canada, with a focus on the Church’s “morality” since even the Canadian reporter interviewed on KUER acknowledged there is no evidence that any tax laws have been violated.

In a nutshell, the 60-Minutes story and related articles make a number of unsubstantiated claims about and against the Church for its financial dealings in Australia and in other countries, such as alleged abuse of Australian tax laws and alleged failure to disburse funds to care for the poor and the distressed.

I want to be upfront about why I would offer this opinion piece. I have never done this before. And there’s no hiding the fact that I love this church, which I have observed as a member over my entire life blessing and helping the poor and distressed in countless places and circumstances. It is hurtful to me and other faithful members of the Church to see the Church unfairly attacked and slandered in this manner.

I also have a particular connection with Australia and am thankful to have cherished friends (mates) there as a result of my having lived there for three of my high school years from 1968 to 1971. My parents served as volunteer missionaries for the Church in Adelaide for three years and later in Sydney. And so, this incomplete and misleading reporting strikes me as being deceptive and harmful to my Aussie brothers and sisters!

Over my 36-year career as a former tax, business, and estate planning attorney/CPA, I observed from my own numerous interactions with church tax professionals related to the dealings of my former clients with the Church that the Church and its tax advisors have always been fastidious about strict compliance with taxation laws and regulations relating to charitable giving.

Bias bleeding through. The particular slant and prejudice of associated reporters are not hard to identify. For starters, since at least October 2018, the President of The Church of Jesus Christ of Latter-day Saints, Russell M. Nelson, has pleaded with both its members and with news organizations to refer to the Church by its proper name, The Church of Jesus Christ of Latter-day Saints. As soon as a news story leads out by calling us “The Mormon Church” or “Mormons,” it’s become increasingly clear that this a bright red flag of bias, indicating that this news organization is in attack mode and has no respect for the Church and likely no interest in objective, honest reporting on the topic presented. In the 60-Minutes story and related articles, that is exactly how the attack starts, by an in-your-face disregard for the correct name of the Church and its members. Indeed, the article by the Sydney Morning Herald goes so far as to sarcastically refer to the Church’s family of related entities as “Mormon Inc.” To me, this is disrespectful and a true sign of the real smear motive of the author(s).

Even the music and lyrics in the background of the 60 Minutes story are clearly and cleverly orchestrated and calculated to send negative vibes/messages about the Church. Those are matched by creepy video segments of a supposed single young male missionary going door to door by himself for the Church (which clearly never happens since they always go with one or more companions). To me, these were also big red flags of bias which signal little to no serious intention to give an honest, balanced view of the important subjects being discussed. Throughout the reporting, there are multiple quotes from disaffected former members of the Church, who appear to be their main sources. In fact, Ben Schneiders, who again appears to be the primary force behind these stories, has a history of misleading and inaccurate religious financial reporting and, in the early days of this story, engaged in misleading behavior about the breadth of the investigation.

Which is too bad. Because with the cynical bias removed, this story could be one about tremendous charitable giving organized quickly, run efficiently, and responsive to the incentives of the Australian government.

There are five key claims made by these news organizations—each of which deserves a forthright response. In what follows, the direct quotes are from the main article in The Sydney Morning Herald, followed by some context notably left out by the journalists involved.

Claim #1: “The global Mormon church has overstated the amount it gives in charity by more than $US 1 billion ($1.56 billion), apparently to make itself appear more generous than it actually is … In public statements, the Church has claimed its global giving through its charity arm, Utah-based Latter-day Saint Charities increased by $US1.35 billion between 2008 and 2020.”

The Herald provides no reference or support for this allegation of what the Church has supposedly said in “public statements.” What this report seems to be missing is that Latter-day Saint Charities is one of multiple organizations through which the Church provides charitable giving—so we should expect the Church’s total charitable giving to be much larger than what is listed in the audited financial statements provided by Latter-day Saint Charities.

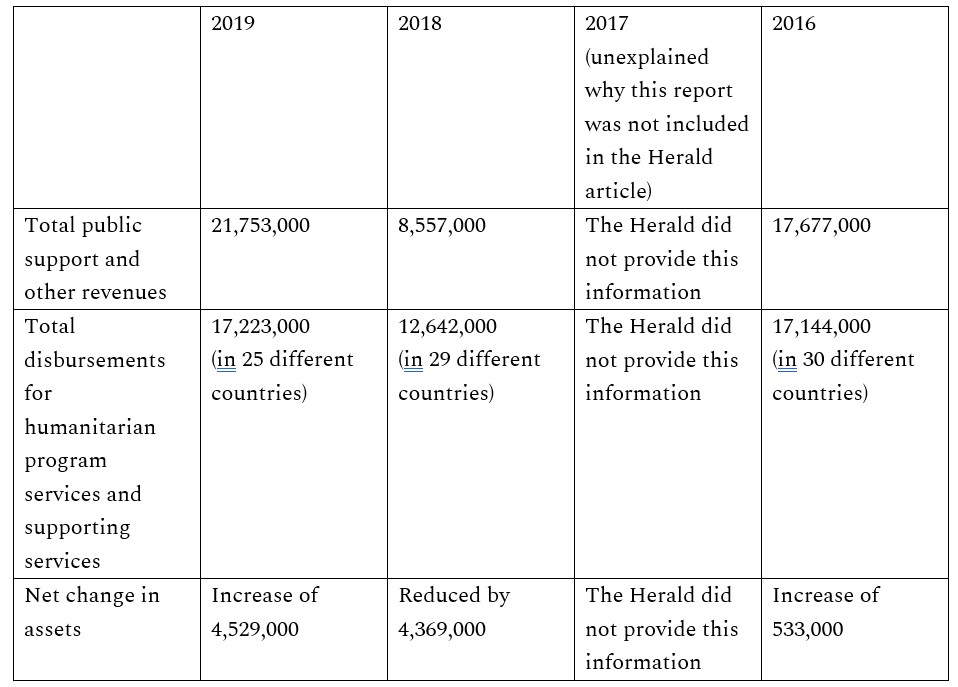

I put together the following table summarizing the three audited financial statements referenced in the Herald article:

Among other things, this table demonstrates that this particular entity of the Church of Jesus Christ has indeed disbursed most of the funds it has received towards charitable causes.

If the desire was to consider and present a complete and honest picture of the Church’s charitable activities, the Herald article could have referenced other public information provided by the Church, such as “Caring for those in Need: 2021 Annual Report of The Church of Jesus Christ of Latter-day Saints.” Why not even mention that report? Referring to this 2021 report, President Dallin H. Oaks, First Counselor in the Church’s First Presidency, provided this summary information in the October 2022 General Conference of The Church: “Our 2021 expenditures for those in need in 188 countries worldwide totaled $906 million—almost a billion dollars. In addition, our members volunteered over 6 million hours of labor in the same cause.”

To reiterate, the charitable activities administered through LDS Charities are only a small part of the expansive outreach and financial disbursements provided by the Church to the poor and the distressed as a result of the generous donations of Latter-day Saints around the world. Any attempt to capture the full picture of the Church’s finances would simply have to pay attention to the many other capital and operational expenditures associated with its work in the world. That includes temples, chapels, missionary work, higher education, church education, and family history, among other things—all of which are enormous investments and none of which are profit-making endeavors.[ref num=”1″]

Is any of this included in the calculations proffered by these articles? Not at all. Thus, the Herald article falls woefully short in giving a complete picture of all the good the Church does throughout the world. Surely these reporters had to know that they were putting the Church in a bad light based on only a very small part of the big picture.

Claim #2: “In addition, the Church runs a $US 100 billion, tax-free investment fund, Ensign Peak Advisors, which has quietly built up major stakes in blue-chip firms and now has multibillion-dollar investments in Apple, Microsoft, Amazon, and Google owner Alphabet. It also invests in major weapons manufacturers, including Lockheed Martin, Boeing, and Northrop Grumman. Ensign Peak is supposed to be used to fund charitable and other spending, but former insiders alleged it was almost entirely used to stockpile cash and investments.” One former disaffected member also claims that what the Church has done is “totally unethical, absolutely a case of fraud.”

Remarkably, these sweeping generalizations about partial truths are made by reporters and interviewees without any reliable evidence. The Herald article states that it has relied upon public filings with the SEC for these claims. Ensign Peak does, in fact, voluntarily file quarterly 13F reports with the SEC, though apparently not required by law to do so. That’s pretty impressive transparency. As of June 30, 2022, total equities of approximately $42 billion are shown in its 13F filing. And yes, it’s likely that this number is even larger when you also consider other holdings such as bonds and international equities.

The reality is that despite the whistle-blower report being made more than three years ago, no fraud has been uncovered or reported. It is, therefore, irresponsible for 60 Minutes Australia and The Herald article to include unsubstantiated claims from disaffected members as to the amount, purposes, or legality of these accumulated investments.

Given all of the committed expenditures the Church faces in its worldwide religious operations, it is obvious that the Church needs very substantial resources, including for “a rainy day.” Shouldn’t every institution be operated to live within its means and save for “a rainy day”? Every time there is a downturn in the economy, I appreciate so much the wisdom and foresight of our inspired leaders. I wish our US Federal Government would follow this example of living within a budget and getting out of debt.

The fact the Church has built up a substantial reserve of investments is something positive to be lauded rather than meriting suspicion. If you were to study the history of the Church, you would learn that the Church was burdened with debt and struggling financially in the early 1900s. I, for one, am thankful to see that the Church has come out of those very difficult financial circumstances to build up a substantial fund for rainy days.

As the Church builds up reserves for all of its programs and for future unforeseen hard times, would these reporters have the Church hold all of these funds in cash?!? That would be an unwise investment indeed! As a member, I am thankful the Church is investing its reserves responsibly, including securities, farms, and other real estate investments.

The 60 Minutes piece even contained a silly statement by one of its interviewees speculating that the Church is saving all this money for the time when after Jesus comes. In all my life, I have never heard a leader of the Church make such a statement, and I am confident the Herald will not find such a verifiable statement anywhere from a general church leader. Again, this seems to be smear rhetoric intended to harm the good name and reputation of the Church.

Claim #3: “Mormons are required to pay 10 percent of their gross income in tithing, a significant financial impost on followers. Nielsen said this was hard on poorer Mormons, particularly in the developing world, describing it as “an extremely regressive tax.”

This claim is undeniably false. Yes, members of the Church believe that this is a commandment from God, just as it was in ancient times of the Bible (Malachi 3:8-12). And like all commandments, Latter-day Saints are encouraged to follow it. But members pay tithing as a free-will offering (voluntarily) because we have faith that God will compensate us for our sacrifice.[ref num=”2″]

And what about the widow’s mite? (Mark 12:42,44). It seems clear from the ministry of Jesus that He was not about stopping the poor from sacrificing to make a charitable contribution to those even poorer. If that’s how Jesus felt, then why would we suggest otherwise? It is short-sighted and wrong to call tithing a burden upon any member of the Church, no matter how poor, because God’s promises of compensating blessings are indeed true.

It is also important to note that contributions from members of the Church fall into several categories—only one of which (tithing) is mentioned by the Herald article.[ref num=”3″]

Claim #4: “The joint investigation has also uncovered significant evidence of alleged tax minimization and evasion by the Church, including in Australia and Canada where hundreds of millions of dollars are routed through shell companies or other entities to maintain the tax-free status of its income.”

In relation to the above: “The Age and The Sydney Morning Herald revealed in April that the Church in Australia had structured itself to allow its adherents to collect hundreds of millions of dollars in tax exemptions that are not lawfully available to followers of other religions.”

This is yet another spurious charge against the Church, made by reporters who simply have no serious basis for claiming there has been tax evasion.

If there are lawful ways to use tax laws and regulations to minimize taxes, then that is exactly what any institution or individual should do. There is a difference between tax avoidance (legitimately using tax laws and regulations to minimize a tax bill) and tax evasion (fraudulently avoiding the payment of taxes). As former Federal Circuit Court Judge Learned Hand once said:

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again, the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike, and all do right, for nobody owes any public duty to pay more than the law demands.[ref num=”4″]

If there is a legitimate way for members of the Church in Australia to receive a tax deduction for their tithes and offerings, then, of course, the Church and the Australian Latter-day Saints should avail themselves of that law or regulation.

In this case, especially, the funds are being rerouted to humanitarian causes precisely the way Australian tax law both allows and incentivizes.

In the 60 Minutes segment, the interviewer pressed and pressed the Assistant Minister for Charities, Andrew Leigh, to agree that the Church was somehow involved in wrongdoing and then tried to make Mr. Leigh look like the big bad government for not being willing to do so. Mr. Leigh appropriately respected the Church’s privacy. Believe me, if the Church were violating Australian tax law, the Australian government would be all over this.

But more substantively, Latter-day Saint Charity work in Australia appears to be run with striking efficiency. In 2021, the most recent year data is available on the Australia-specific LDS Charitable Trust Fund, it brought in $100,211,557, distributed $131,604,476, and spent $7,810 on overhead.[ref num=”5″]

Claims that this amounts to a “shell company” appear to be based upon evidence such as them not having a visible enough presence in the country or a paid staff. I have addressed the staffing issues elsewhere in this piece. As for visibility, I have been given to understand that most of their funds are then distributed to organizations like Red Cross, Water for People, and the World Food Program.

In the end, claiming that donating to humanitarian causes is a “tax minimization strategy” is extraordinarily cynical. I understand that Australian tax law incentivizes donating to humanitarian causes, and the Church has organized its finances in the country to do exactly that.

Claim #5: It is “inconceivable that the Church was making significant global charitable decisions from Australia.”

According to Australian law, charities that qualify for tax deduction purposes must be run out of Australia. And the recent reporting on this matter takes for granted that this couldn’t possibly be the case—suggesting that because Latter-day Saint Charities Australia has no paid staff, it can’t be led within the country. But this speculation is simply not true.

The high efficiency of the fund is made possible by the Church’s culture of volunteerism. As Public Square Magazine has confirmed, Paul Gray and Carl Maurer direct the fund. Carl Maurer is from Brisbane, served a mission in Perth, and attended Griffith University in Queensland. He built his career in the swimming pool industry. Paul Gray is from the Sydney area. He attended the University of South Australia and works as an accountant. In addition to his philanthropic work with the Church, he is involved with Australian charities focusing on child safety.

Does Australian law allow these people to coordinate and work with global Latter-day Saint Charities? Clearly, yes. Australian charity expert Krystian Seibert from Swinburne University’s Centre for Social Impact says that qualifying charities can “engage and consult with partner organizations outside Australia.”

This is precisely the type of relationship the Church describes existing when a spokesperson for the Church said it “identified and referred” charitable projects to their Australian counterparts.

Conclusion. We all understand how media outlets are always looking for new material, especially sensational content that will be eye-catching. But as institutions we look towards for truthful investigation, these journalists have a moral obligation to be fair and unbiased in their reporting. We hope and pray they will reserve judgment and withhold attacks when they don’t have all the facts.

And when they don’t—when they instead perpetrate a scandalous and dark narrative impugning an entire people and faith community—what are we to think? Rather than suspect fraud on the part of the Church and its leadership, it’s hard not to conclude in this case that 60 Minutes and the authors of the Herald article are the ones working a fraud and deception upon their viewers and readership.

I obviously trust the Church and its leaders as humble and trustworthy men and women who come from all different professional backgrounds and socio-economic circumstances. Are they perfect? No, of course not. But I am persuaded that they are doing their best to ascertain and follow the mind and will of God, and they are trying hard to build the kingdom of God, help the poor and the distressed, and yet to keep sufficient reserves to cover current and future obligations. This is wisdom!

I am confident that time and honest investigation will continue to vindicate the Church against these wrongful and hurtful allegations—demonstrating that the Church practices what it teaches about being an honorable, honest citizen in the world. As Joseph Smith himself taught, “We believe in being subject to kings, presidents, rulers, and magistrates, in obeying, honoring, and sustaining the law.”

News organizations should operate in good faith and give the Church some credit and recognize all the wonderful and generous things the Church is doing to lift and bless the world. Come on, mates, what we need here is some fair dinkum reporting!

Notes:

(1) Here are just some of the many examples of where the resources of the Church are needed:

- Temples. The Church is a temple-building church. We members of the Church believe that temples are essential in the Lord’s plan to provide saving and exalting ordinances both for the living and the dead. And, by the way, the Church is the only one in the world I am aware of that can explain how God can be fair and merciful to the billions of His children who have lived and died without a knowledge of their Savior and Redeemer, Jesus Christ. Temples, of course, are not income-producing properties. And we as a people are gladly making a priority investment in expanding them over the earth. The Church has 169 operating temples located around the world. Four of those are being renovated. The Church has an additional 55 temples under construction, and 72 temples announced. When all the temples announced so far in the world are constructed, there will be 300. And this number will undoubtedly continue to grow each year. Each temple is constructed as the Lord’s house, and, like King Solomon in the Bible, the Church spares no expense in building with the very finest of designs, construction materials, and furnishings. The Church does not provide numbers publicly regarding the cost to construct these temples, but the cost is obviously enormous, in the millions or tens of millions of dollars depending upon the temple. And then there obviously has to be a significant annual operating budget to keep each temple functioning in its critically important role. These temples are being built in many countries around the globe, including those where the locally donated tithes and offerings would not cover a fraction of the cost.

- Gathering Scattered Israel—Missionary Work. As with the Apostles of old, the Apostles of our day have also received a divine commission to take the Church’s message of salvation and peace through Christ to every nation, kindred, tongue, and people. And the leadership of the Church takes this command from the Lord very seriously. This is reflected in a robust missionary program around the world. Currently, there are approximately 54,500 full-time teaching missionaries serving as volunteers throughout the world and 36,600 Church-service missionaries. While it is true that missionaries pay a portion of their monthly living expenses, this missionary program is very heavily subsidized by the Church, including providing a fleet of cars to many of the teaching missionaries, providing apartments and a monthly food budget, covering medical expenses, and support from mission leaders and office staff in Church-owned properties at 407 different locations around the world. Again, these are non-income-producing properties. The Church’s missionary program also includes missionary training centers located in various cities around the world, with extensive staffing and other operational costs. These mission-program properties of the Church have large budgets for both capital improvement and operations.

- Education. The Church heavily subsidizes education through its three BYU campuses (Provo, Utah, Rexburg, Idaho, and Oahu, Hawaii). Again, the capital improvement and operational budgets for these properties is enormous. There is also a low-tuition BYU Pathways Worldwide program that provides online education to a current enrollment of approximately 57,000 students around the globe.

- Family History. The Church sponsors Family Search and other online programs and phone applications to assist both church members and friends around the world to find and connect to their ancestors and other relatives through the largest genealogical data base in the world. Accounts are free to everyone. And the Church owns and supports physical family history centers in many locations, to give hands-on help.

- Religious Education. The Church also sponsors religious education for students, beginning in 9th grade and continuing through the college years at hundreds of seminary and institute buildings around the world. And yes, you guessed it, more non income-producing properties with enormous annual budgets.

- Houses of Worship. The Church obviously owns thousands of houses of worship around the world. Currently, the Church has approximately 31,300 congregations (called wards) and it supplies buildings and operating budgets for these non income-producing chapels.

- Visitors Centers. The Church owns and operates visitor centers at multiple locations around the world.

- Other Related Charitable Entities. The Church has other related foundations and entities that are used for the disbursement of funds for humanitarian and charitable purposes.

(2) That means, in the end, members will not miss those funds. As promised by the ancient prophet Malachi, we believe that God will open the windows of heaven and pour out a blessing upon us In my own life, this promise has been fulfilled, and millions of faithful members around the world would similarly affirm the fulfillment of this promise from God. It also seems clear that God has richly blessed His earthly kingdom to finance and enable His work to be carried out throughout the world

(3) Different categories of contributions include the following: Tithing (10% of our income—these funds are understood by us to go towards buildings and church programs and operations); fast offerings (these funds are contributed by members to the Church for the use by local leaders to care for the poor and needy in their own geographies and congregations); humanitarian contributions to a general fund of the Church, for use by the Church to help many humanitarian causes around the world; missionary fund contributions (these are voluntary contributions to assist with the expenses of the Church’s missionary program—see related discussion herein); temple fund contributions (these funds are applied towards the Church’s numerous temples around the world—see discussion herein); and other contributions.

(4) Helvering v. Gregory, 69 F.2d 809, 810-11, 2d Cir. (1934). Even though the Herald article is talking about Australian taxation, I submit this statement by a US judge is still both applicable and weighty.

(5) This LDS Charitable Trust Fund is a separate entity operating apparently within Australia—distinct from the Latter-Day Saint Charities organization in the US whose numbers are referenced in the earlier table. The Church works through multiple entities in sharing resources around the world. The fund’s published reports also show money being received and then disbursed for charitable causes.