Part 2: Our assumptions about and attitudes toward the poor

Our history books, our politicians, and other forces have combined to teach us what we think we know about the poor. Although negative myths about poverty and poor people (especially poor people of color) have persisted despite repeated research demonstrating the contrary, those negative myths still drive public policy and often our individual attitudes and actions toward those in need. Here are some of the most prevalent poverty myths:

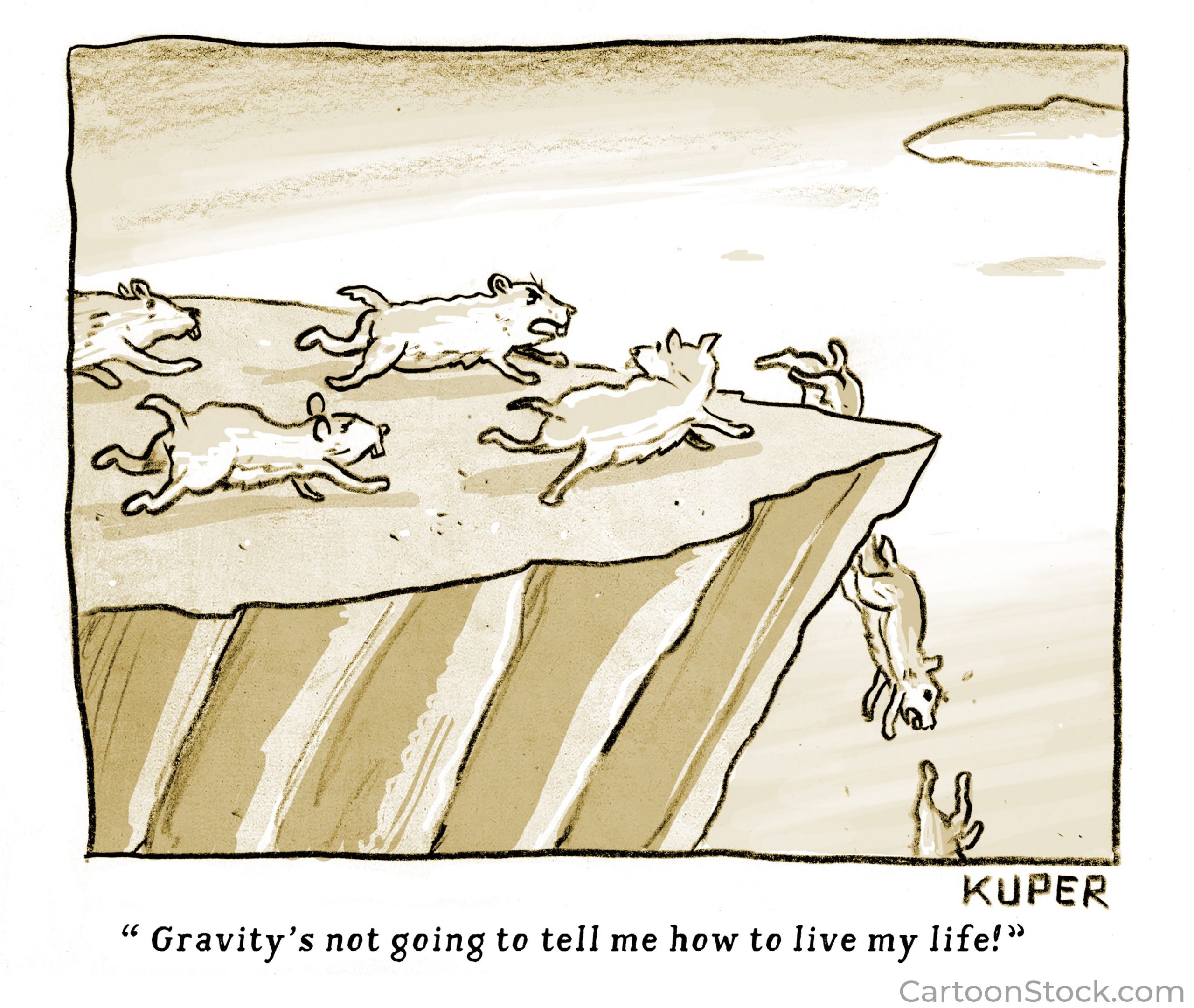

Myth 1: “The poor could lift themselves out of poverty by working harder.” This is similar to your parents telling you that you can be anything you want if you just work hard enough, a suggestion that most of us outgrow when we realize that our stint on Broadway, in the White House, or in the ranks of professional athletes is unlikely to materialize no matter how hard we work—too much depends on luck, timing, and talent in addition to hard work. Most poor people are working just as hard or harder than the affluent, connected, and advantaged, but our society has organized employment, the economy, and getting ahead in ways that benefit those who have resources and penalize those who don’t.

In her excellent autobiography, There Is Nothing for You Here: Finding Opportunity in the Twenty-First Century (Mariner Books, 2021), Fiona Hill, a Russia expert who served on the staff of the National Security Council and is now at the Brookings Institution, details how she grew up in the North East of England—an impoverished area deserted by industry and bereft of social programs to help displaced coal miners under Prime Minister Margaret Thatcher’s austerity budget. While Fiona was always good in school, the opportunities for a good education were not available to children in that place and time. By luck and some fortuitous contacts, she managed to get into St. Andrew’s University in Scotland and, from there, to capitalize on her own hard work and intelligence. But things were against her—she knew nothing about applying to college and nothing about going to college; her accent marked her as lower class in Britain’s hierarchy. There were few-to-no resources to help her, resulting in things like getting an interview for a scholarship or similar advantage but being unable to pay for the transportation and lodging needed to apply for the chance. Hill managed to claw her way up to achievement and economic security in the face of class discrimination and sexism. She draws parallels between the situation in her home area and the Rust Belt–type problems in the United States, pointing out correctly that systemic racism in the United States makes the upward struggle even more difficult for black Americans. She skillfully explains the importance of one’s place of origin in determining the benefits and barriers to success. We all receive government assistance.

Myth 2: “People who accept government benefits become dependent and don’t want to work.” There are two categories of government assistance in the United States: “welfare” for the poor and “tax breaks” for the more affluent.

“Welfare” includes food stamps, housing vouchers, subsidized daycare and housing, WIC supplemental nutrition, the Earned Income Tax Credit, Medicaid, SSI and SSDI payments, and unemployment benefits, all of which are available in limited quantities, are hard to qualify for, and are easy to lose. “Tax breaks” include the Child Tax Credit (which in 2020 benefited parents with incomes up to $150,000 before the benefit was phased out for those with higher incomes), the mortgage interest deduction for first and second homes, government-subsidized retirement benefits, government-guaranteed student loans for higher education, 529 college savings plans, the tax exemption for the value of one’s employer-sponsored health plan, low tax rates on capital gains, and the nonexistent estate and gift taxes, all of which accrue mostly to middle-class and wealthy families and are relatively easy to get and difficult to lose so long as your income and wealth continue. According to poverty researcher Matthew Desmond, these “tax breaks” cost the government $1.8 trillion in 2021—more than twice what we spent on the military and national defense, and far more than was spent on “welfare”—and about half of these “tax breaks” went to families in the top 20 percent of the income distribution.

Yet we who get these breaks probably feel entitled to them; we certainly don’t believe that they are causing us to become dependent on government handouts. By their nature, they continue to be available if we keep working into retirement, so we are not tempted to quit.

Similarly, the poor are not becoming dependent on government handouts, nor are they tempted to stop working even when they are technically eligible for retirement. The idea that the poor are lazy is a long-promulgated slander. Since the Industrial Revolution required business owners to find ways to lure “the masses into their mills and slaughterhouses to work for as little pay as the law and market allow,” the word has gone out that the poor are “idle and unmotivated.” But researchers who studied cash welfare payments to young single mothers in the 1980s and 1990s discovered that most recipients gave up the payments within two years, sometimes receiving benefits again “for limited periods of time when between jobs or after a divorce.” The researchers concluded, “The welfare system does not foster reliance on welfare so much as it acts as insurance against temporary misfortune.” Temporary misfortunes are much more undermining for the poor than for the better-off, who often are able to turn to savings, helpful family members, banks willing to loan them money, and other resources that often are not available to the needy.

Further, the cash payments that were available under the welfare system of the 1980s and 1990s (Aid to Families with Dependent Children, or AFDC) have disappeared in the name of welfare reform. Only under very limited—almost nonexistent—circumstances are any governments in the United States now making cash payments to the poor under the current system of Temporary Assistance to Needy Families, or TANF. TANF monies are supplied by the federal government to the states as “block grants,” and they are used to fund everything from relationship education to juvenile justice administration, but seldom are they aimed at reducing poverty. Desmond notes, “Nationwide, for every dollar budgeted for TANF in 2020, poor families directly received just 22 cents.”

The poor definitely are not milking the system for every available dime. Hundreds of billions of dollars annually are left unclaimed by people who qualify for assistance—food stamps, the Earned Income Tax Credit, Medicaid, the Children’s Health Insurance Program, Temporary Assistance for Needy Families, and unemployment insurance. These forms of assistance are so difficult to get and keep that many poor families are unable to face the form-filling, line-standing, investigations into their meager finances and need to repeatedly guard their eligibility. For example, a worker can lose food stamps because she was scheduled for a few more hours on the job in one week or month (even though her hours were cut back again after that), resulting in the need to apply all over again for the lost benefit.

The idea that benefits make recipients “lazy,” a variation on the theme that government assistance leads to dependency, conceals other possible reasons why people may not be working: disability, lack of childcare or eldercare, lack of transportation, lack of medical or dental care that would make them attractive job prospects, lack of expected clothing, lack of literacy or language skills (whether they are native English speakers or not), or lack of computer or other skills needed to search for jobs.

During the pandemic, the increased unemployment and other benefits for those who struggled economically (such as emergency rental assistance and moratoriums on evictions) cut the level of poverty for all Americans—all racial and ethnic groups, rural and urban dwellers, all ages—by 16 million people in 2021 as compared to 2018. The poverty rate for children was cut in half. The poor had their lot improved temporarily during the pandemic and perhaps got a glimpse of what life could be like when not scraping by with an exploitative job, but as soon as politically possible, governments withdrew the increased unemployment benefits, the back rent was due on pain of eviction, the food stamp benefits decreased, Medicaid eligibility had to be proven again, and new or continuing problems—lack of reliable childcare, increasing food, gas, and rent prices, children with increasing rates of depression and anxiety—cropped up.

Better-off Americans also got government benefits during the pandemic in the form of stimulus payments, the more generous Child Tax Credit, and the same increased unemployment benefits. Small business owners were eligible for tax credits, paid leave credits, emergency capital investments, and the Paycheck Protection Program, while businesses of all sizes were eligible for employee retention credits and payroll tax deferral. Airlines, cargo air carriers, aviation contractors, and national security businesses received billions in payroll support. State, local, and tribal governments also received federal grants to support their residents and prevent economic hardship and position them for economic recovery. These programs involved billions in government spending. Even though some people took advantage of their availability to acquire benefits to which they or their businesses were not entitled, they seemed justified to prevent economic and humanitarian crises as a result of the pandemic. But only the direct benefits to the poor were later labeled as dependency-creating handouts that needed to be withdrawn as soon as possible to get low-income recipients back to work. So many dollars result in such dismal outcomes.

Here’s the bottom line: The most recent data compiling spending on social insurance, means-tested programs, tax benefits, and financial aid for higher education show that the average household in the bottom 20 percent of the income distribution receives roughly $23,733 in government benefits a year, while the average household in the top 20 percent receives about $35,363. Every year the richest American families receive almost 40 percent more in government subsidies than the poorest American families.

Government assistance does not make people lazy, dependent, or unwilling to work; if it did, then we could all claim those adjectives to describe ourselves because we are all receiving government assistance. The question becomes why the help available to the poor is not improving their lives more than it is and why so many people remain in poverty.

Myth 3: “The poor who want to live better lives, and even get ahead, can do so if they just take advantage of the benefits available to them.”

Government attempts to lift people out of poverty, while far better than nothing, have not succeeded—government spending on antipoverty programs, driven mostly by healthcare spending, increased 237 percent between the beginnings of the presidential administrations of Ronald Reagan and Donald Trump, but as Desmond notes, “when it comes to poverty reduction, we’ve had fifty years of nothing.” And despite all the money spent when it comes to improving healthcare access for the poor, we still have the most expensive healthcare system in the world while lacking universal health coverage.

One wonders why so many dollars result in such dismal outcomes and why Americans continue to allow suffering on the massive scale that is poverty in our incredibly wealthy country. While government programs are alleviating much suffering, the overall picture remains one of millions of people wearing out their lives as they try to put together food, shelter, healthcare, and other necessities, often without getting ahead, no matter how hard they work, and sometimes giving up in despair. Below the circumstances of the working poor are the plights of the mentally ill and the otherwise disabled or chronically unhoused who are living reminders on the streets of our cities of the failures of anti-poverty programs.

Government financial assistance for the poor may be inefficient, inadequate, and insensitive to philosophical differences regarding how best to help those who are struggling, but it is nevertheless a means to reach the most people in need with more consistency than individual and non-governmental organizational efforts. Nevertheless, even if a family qualifies for every one of the anti-poverty programs the government provides, they do not have enough money to make ends meet, much less enjoy the prosperity that would come with a full-time job with a living wage and benefits. Just holding the cheaters to account would be enough to lift the entire poor population.

Other government benefit programs are similarly difficult to navigate and require a commitment to make repeated attempts to satisfy what seems like an arbitrary, bloated bureaucracy of unfeeling and unhelpful gatekeepers, with a slim hope of success—and then to reapply or pass a renewed eligibility test for those hard-won benefits repeatedly or have them stripped away.

Consider that people applying for the various government benefit programs may be what the Victorians genteelly referred to as “in reduced circumstances”—having lost a home, a job, a relationship, family members, and other societal supports that keep the rest of us afloat financially and emotionally. Or, worse, and perhaps more often, those who need assistance may never have known the security of those supports; they may have experienced or are experiencing substandard education, pollution in their homes and neighborhoods, a lack of medical care, or exposure to crime, violence, trauma, or abuse. They may have an emotionally supportive family or community that is not able to help them financially, or they may have a dysfunctional family or deteriorating community, or no family or community at all.

These are the people whose flimsy but desperately necessary help from “welfare” is being chipped away by politicians who consistently target these programs as a way to cut government spending or decrease levels of seldom-proved fraud, waste, and abuse. And yet we could abolish poverty entirely in the United States without new programs, Matthew Desmond writes, by empowering the IRS to collect the more than $1 trillion per year lost to tax cheats—multinational corporations and wealthy families who are avoiding taxes that they owe under current laws. There are other things we could and should do to improve the current system of welfare benefits so that it would be more efficient, effective, and compassionate, but just holding the cheaters to account would be enough to lift the entire poor population of the United States out of the poverty that creates a different world, with different rules, and with so much unnecessary suffering and despair, for those trapped in poverty.